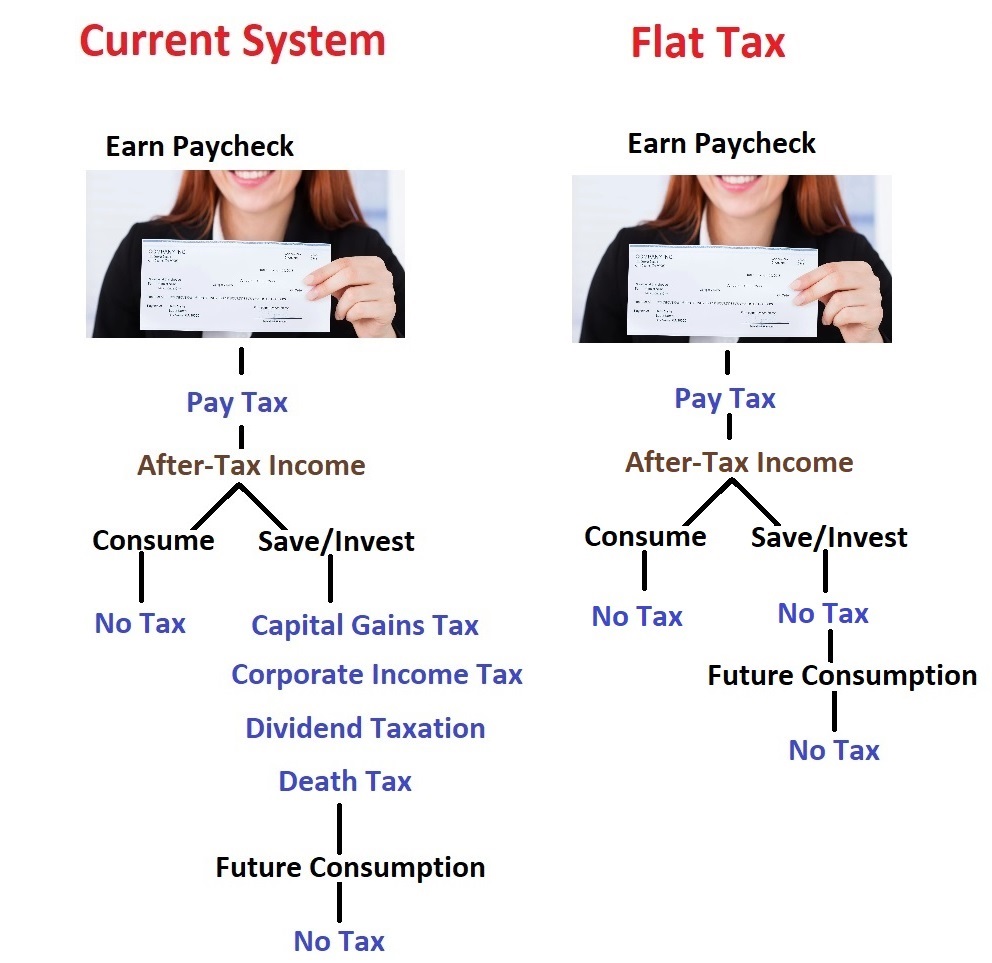

In particular, they differ in the level of the basic income allowance to be exempted from taxation, the level of statutory tax rates for personal and corporate income, and the definition of tax bases, for instance regarding the tax treatment of dividends.Įstonia, Latvia, Lithuania, Romania, Bulgaria, and Hungary had a flat PIT rate. The Baltic countries were the first to introduce flat tax systems among the countries considered in this paper: Estonia and Lithuania introduced such a system in 1994 followed by Latvia in 1997. The actual tax reforms have departed from the “single tax rate” principle and given rise to a variety of tax schedules. In practice, however, none of the aforementioned countries has adopted a pure flat tax system. The “flat tax” concept is usually associated with the academic works of Hall and Rabushka who consider a single tax rate applied to both personal and corporate income beyond a given threshold or “basic allowance”. Over 20 countries in the world, including central and eastern European Member States and EU neighboring countries, have introduced a so-called “flat tax”. And many nations, including Scandinavian countries, are reducing tax rates on individual capital income and lowering taxes on wealth. Corporate income tax rates have dropped by almost 20 percentage points. Maximum personal income tax rates, for instance, are 23 percentage points lower today in developed nations than they were back in 1980. They know the geese that lay the golden eggs will fly away if they impose bad tax law. This is why so many nations had to lower personal income tax rates after the Thatcher and Reagan rate reductions - and why many nations have been lowering tax rates on business in response to Ireland's incredibly successful 12.5 percent corporate tax. Certain politicians still believe in high tax rates, of course, but they feel compelled to move in the opposite direction since it is now increasingly easy for labor and capital to escape oppressive tax regimes by crossing national borders. Thanks to globalization, many nations are adopting better tax policies in the last decades.

0 kommentar(er)

0 kommentar(er)